In March 2023 RimuHosting will have been providing Linux servers for 20 years.

For this occasion, and in a break from our typical technical posts, I’ll be writing about a recent RimuHosting business initiative. One that will help us continue to fulfil our mission to provide our customers a hassle free hosting experience.

20 years of great workmates

I’ve been fortunate to work with a great team here at RimuHosting. I respect my colleagues skills and knowledge.

Running a hosting business is not always easy. ‘Bad things’ sometimes happen. Typically at 3AM on a Sunday. Support is not a Monday to Friday 9-5 affair. Technology often requires a lot of convincing to work the way you want it to.

Despite the high bar for acceptable performance, my colleagues demonstrate levels of responsibility, determination, and care that make me proud of the service we provide at RimuHosting.

When you have staff that are that committed, they deserve to be treated well.

Introducing the RimuHosting profit share policy

RimuHosting introduced a profit share plan for staff back in 2021. Each RimuHosting employee gets a share of every dollar of net profit the business makes.

The profit share plan is pretty simple to operate.

Every couple of months (aligning with our GST returns) we figure out our trailing 12 months profit. We allocate a proportion of our net profit to a profit share pool. We allocate the profit share pool among employees. And we pay each person their share as a part of their regular PAYE salary/wages.

Every couple of months, after each profit share payment, we hold a ‘Distribution Day’ meeting. The meeting will typically have a theme that puts our focus on something other than the day-to-day operation of the business, and lets us touch on topics that are about improving the business and the people that work in it.

The profit share plan had immediate benefits.

Finding good staff, particularly in the current market, is difficult. The profit share plan helps us attract the best candidates. And retain them.

We want to foster a ‘culture of ownership’. The profit share plan makes that culture tangible to staff.

The Distribution Day meetings have helped identify and start projects (around things like automation, communication – for example this blog post, and new features). It has also been a good forum to have some deeper conversions around topics like the importance and benefits of learning and professional development. And it has been a good way for us to build consensus and direction around our ‘being useful’ policy aimed at providing free and discounted hosting services to community groups.

The profit share plan is a good fit for our business.

RimuHosting is profitable, and cash flow positive. A profit share plan without profit would not be so appealing. If your business is not yet cash flow positive then concepts like gainsharing may apply (where staff can participate in cost reductions or revenue improvements).

We want to be providing hassle free hosting to clients for many years to come. Succession planning pathways are easier to find when we have experienced staff with a deep understanding of the business.

RimuHosting is a closely-held, private business. We do not have outside investors. We get to act in a way that is consistent with our personal principles. All decision makers get to live with the day-to-day consequences of those decisions.

We made decisions about how our profit share plan works

We opted for regular (every two months) payments. We chose this over, say, a larger annual payment. We do not want demotivated staff biding their time in golden handcuffs waiting for end of year bonuses before quitting.

We don’t base an employee’s proportional share of the profit pool solely on things like salary, seniority, or job title. Instead each employee is given a weighting. That weighting can change between distribution days. In our profit share policy we let staff know how they can affect their weighting. And staff provide input on each other. Key employees making outsized contributions (irrespective of seniority or title) can be appropriately rewarded.

We developed a ‘black box’ profit share policy. The implementation means the only number disclosed to staff is their distribution day payment. Numbers not disclosed include: net profit, profit share pool size, nor how one individual’s payment compares to anyone else’s. In lieu of this transparency, our external accountant audits the scheme each year – reconciling the scheme to payroll and financial accounts – and reports the result to staff.

We elected to make participation in the policy as broad as possible. From the newest, most junior employee, to the most senior.

The profit share plan has a few implications for staff

An employee’s distribution day payment will vary each time, depending on how the business is going, and how they are contributing to the business. Staff need to budget accordingly (and this is something that should be discussed with your staff).

Staff may find themselves seeing things differently. If the business hires someone will your slice of the pie get smaller? Or will the pie get bigger?

Staff may feel some peer pressure to contribute to the business.

We considered alternatives to the profit share plan

We could have tracked along with the status quo, without introducing a profit share plan. That did not sit well with me. Consistently, I would see staff going above and beyond what should be expected of a salaried employee. When staff behave like owners, they deserve an owner’s rewards.

We could have introduced an employee stock option plan. There are a few things that can make that tricky: Tax treatment. Business valuation. Should staff who leave be able to retain their equity? Does the business buy that equity back? At what price? Voting vs. non-voting shares. Vesting period? If there are no plans to sell business, there is no rain making ‘exit’ event on the horizon. Do staff have to pay for the shares? Does the business loan them the money to do that? How do we value the historical sweat equity they have already invested to help build the business?

We could have waited to be acquired (as seems to happen so often with hosting businesses). That gives the owners a stack of money to pop into their bank accounts. But it can be disruptive to frontline staff, who rarely receive any benefit from the sale. And in many cases acquisition news has been received poorly by clients, who fear – and often receive – disruptive changes, and even service discontinuance.

In the past we have made KPI-linked bonuses. These have been a good way to align staff with specific targets. And they can be complementary to the profit share plan.

Some organisations eschew traditional company structures entirely. You see options like worker democracies or worker collectives. Or charitable organisations (charity is still an option in for-profit businesses!). Your positions on the amount of hierarchy that is required in a business and what decision making power each person has could make these organisational forms an appealing option.

Implementing a profit share policy

18 months after introducing the profit share policy, I have no regrets about introducing it. I sleep much better at night having it in place.

When researching this topic I struggled to find concrete examples on how to go about implementing a profit share plan. So in addition to writing about the policy, what follows are the actual details of the policy.

Have a profit share thought you’d like to contribute? Email Peter at RimuHosting or tag me on twitter.

RimuHosting black box profit sharing policy

Objectives:

- Share business success with staff.

- Link contributions and reward.

- Create a culture of ownership.

- Retain good staff, recruit good staff.

- Spread responsibility.

- Foster leadership from within.

On top of salary and bonuses:

- Each staff member’s remuneration should reflect their market value. That may include performance targeted bonuses, or general bonuses. It may also include allowances for things like being on call or cost reimbursements for use of a home office. Any profit share would be on top of that.

Participation:

- Staff will be invited into the scheme. Participation from payment to payment is at the sole discretion of the scheme administrator.

- To avoid us/them situations, the intent is that the profit share plan should be inclusive of as many active staff as possible.

- Participation is intended for current, active staff committed to a long term role in the business. It is intended for staff who were active during the whole payment period.

- Staff participation in the profit sharing may be paused during periods of work inactivity like study leave, parental leave, sabbaticals, extended annual leave, or longer term unpaid leave.

- Staff participation may be paused if they fail to meet KPIs, are undergoing performance management processes, or disciplinary processes.

Calculations:

- RimuHosting will be clear and transparent with staff on the policies and formulae behind that.

- Most financial information remains confidential and will not be shared.

- Profit share details are private and confidential. With the exception that staff are allowed to discuss their own details (e.g. the amount they receive). This exemption applies because the information is personal to them, it pertains to them (rather than the business). This exemption does not imply that they *should* – or need to – reveal that information to anyone.

- RimuHosting will request an annual letter from our accountants confirming the policy is working according to the profit share policy rules.

Payments:

- Payments will be made at regular intervals throughout the year. For the time being, payments will be made within 30 days of GST return dates, every second month. These are done on management accounts.

- Between 50-80% of the profit share pool will be paid on the regular payments (management accounts are typically not full/complete/checked).

- A wash up payment will be paid after the accounts are finalised (typically August – September)

- In the event the profit share policy stops or starts during a financial year, the profit shared will relate to the profit from the active period. An easy way to do this may be to pro-rate the amounts.

- Payments (bi-monthly and wash up payments) will be prorated for staff who were not employed or participating in the scheme for the full period (e.g. joining during that period).

- Payments paid out via payroll system. So PAYE deductions are made at time of payment.

- No entitlement is accrued between payments. If a staff member resigns, there is no entitlement to a payment after that point.

- Payments are inclusive of employer KiwiSaver contributions, if any.

- The intent is that profit share payments should not increase other staff remuneration payments like holiday pay, or annual leave, or employer kiwisaver contributions. Where we cannot avoid that, then we would calculate what the non-profit-share payment (holiday pay, sick leave pay, kiwisaver, etc) would have been were the profit share not paid, and that amount would be deducted from the employee’s next profit share payment. This prevents ‘double’ rewards (getting higher salary related payments because you had a profit share payment).

Changes to policy:

- The intent is to trial the policy, work towards a longer term commitment to the policy.

- The intent is to structure the policy so it can be ‘sweetened’ over time should it prove successful.

- Initial commitment to this policy for a trial 6 month period to July 2022. Should it work out, the scheme administrator may make a pledge each year to re-commit to the policy for the next 2 years.

- Material changes to the policy or profit share calculation formula will be notified to staff.

- Changes to values assigned to the formula will not necessarily be notified to staff. For example, staff may not be notified when their percentage of the profit pool changes; nor if the value of arms-length-adjustments change.

- The above rule notwithstanding, staff will be notified if any of the tiered profit share percentages reduce. The amount or percentage of the reduction need not necessarily be notified.

- The scheme may be suspended should the business need to to meet its financial commitments (solvency).

- A business transaction resulting in a change of beneficial ownership of shares (merger, sale, purchase) may result in the policy being modified or cancelled without notice. But it may also trigger some other benefits to staff.

- The scheme may be suspended in the event the business is profitable but not cash flow positive. For example, after significant capital investment, setup costs for new service initiatives.

- The scheme administrator reserves the right to amend or cancel the profit share policy at any time without obligation to any further payments.

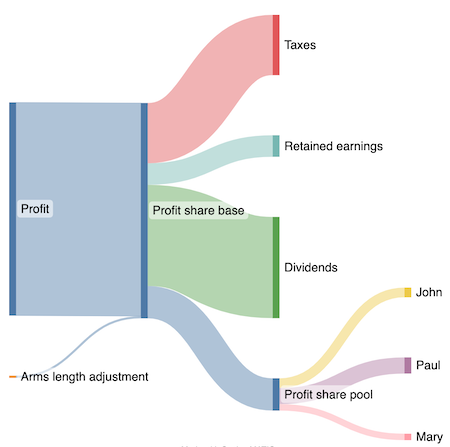

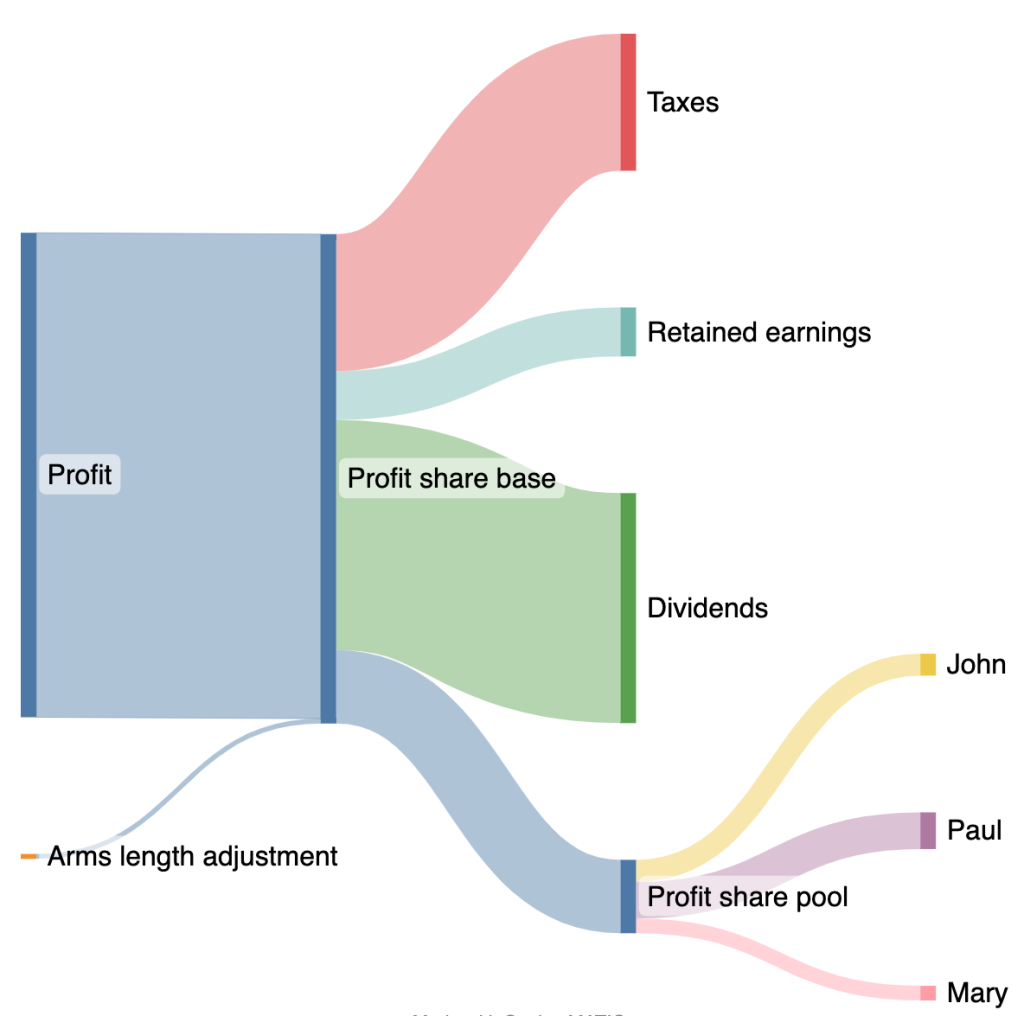

Profit sharing calculation:

- $profit = accounting profit. For interim payments it would be an estimate. For example, based on the trailing 12 months’ performance.

- $armslengthadjustments adjustments to bring related party P&L line items in line with market rates.

- $profitsharebase = max(0, ($profit + $armslengthadjustments))

- $profitsharepcttiers the percentage. Tiered (e.g. x% to a $ amount, y% up to the next band, z% from that band onwards). The percentage will be non-zero at each level.

- $nzemploymentlawadjustments adjustments made to account for payment obligations affected by profit share allocations. This number may be an estimate.

- $profitsharepool = $profitsharebase * $profitsharepcttiers – $nzemploymentlawadjustments

- $profitsharepoolreserve is an amount or percentage temporarily held back from a period’s payment. For example since $profit will be an estimate during the year and only finalized annually.

- $profitsharepooltobeallocated = $profitsharepool – $profitsharepoolreserve

- $individualpct is the percentage of the $profitsharepooltobeallocated to be paid out to an individual. The sum of each staff member’s $individualpct will be 100%. This percentage may change for each individual from payment to payment.

- $individualpayout = $individualpct * $profitsharepooltobeallocated – $nzemploymentlawadjustments (pertaining to that individual)

Individual’s profit share pool allocation percentages

Each staff member will be allocated a percentage share of the $profilesharepooltobeallocated. Some staff will receive a larger share than others. An individual’s profit share percentage will factor:

- Their contribution

- Fulfilling a key role

- Effort, quality of work, and attitude.

- Creating new services with good profit potential

- Co-worker input into allocation

- Leadership (by example, respect from others, mentoring)

- Recent project successes

- KPIs, e.g. around projects or service levels; team and individual

- Historic company commitment

- Staff need (health, extended family needs, housing, emergencies, well being)

- Duration of employment

- Salary (which is likely reflect much of the above, but will also include things like qualifications, experience)

- Input from other staff.

For staff who wish to maximise their profit share:

- Are you doing your best work? What is stopping you? How could you do better?

- Are you saving other people time? Where are the areas you could help?

- Are you delivering “outcomes” or just “being busy”?

- Are you bringing solutions, not problems?

- Are you setting goals, measuring my progress and sharing my successes? Track your projects, record their urgency and priority, be prepared to show all that is on your plate and how you have prioritized your next day, week, month, year.

- Are you mastering your role, developing myself and bringing more value to the company?

- Are you identifying and leading new initiatives?

- Are you setting a good example for others?

- Are your motivations aligned with others around you? Should you have a conversation to better understand or explore or change those stated motivations.

About RimuHosting

RimuHosting has been providing hassle free hosting services to over 13,000 customers since 2003. Based out of Cambridge, we operate globally with data centers in NZ, Australia, the USA, and Europe.

RimuHosting provide hosting services through our targeted offerings:

https://woop.host for affordable, fast, secure WordPress hosting.

https://25mail.st email hosting so your organisation’s leadership can have their own domain name in their email addresses (not gmail’s or outlook’s).

https://launchtimevps.com/ VM servers (with easy to use control panels) for clients that want full control over their websites.

https://pingability.com/ to monitor your websites 24×7 and alert you if there is a problem.

https://zonomi.com to manage all those IP addresses, email and other DNS records.

https://bakop.com for clients needing to safely store their backups ‘off site’ on secure storage (and in a location they choose).